Marketing budgets are undergoing a significant transformation in 2025.

Rising costs, increased scrutiny, and rapid technological shifts have created an environment where marketers must justify every dollar they spend, but they are also being trusted with more responsibility than ever.

The latest Future of Marketing Report shows that investment is growing across many organizations, yet the pressure to be more precise, more strategic, and more revenue-driven has never been higher.

Marketing investment is growing, but so are expectations

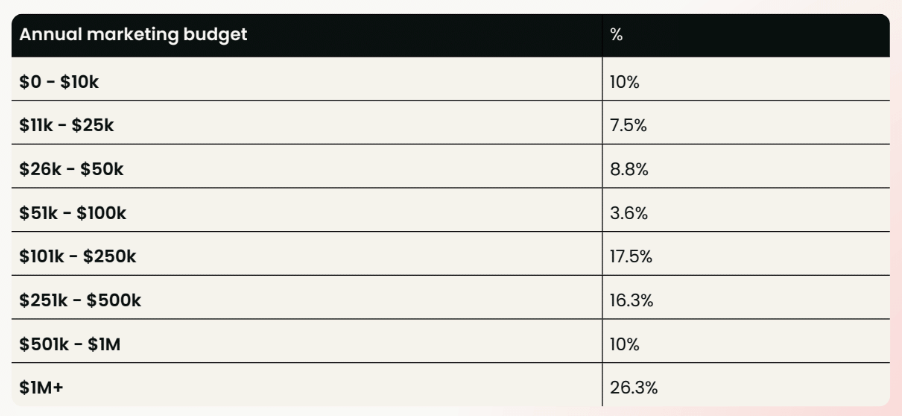

This year’s data reveals an increasingly polarized landscape. On one end, 26.3% of marketers now manage annual budgets of $1M or more, highlighting just how essential marketing has become in growth-focused industries.

On the other end, only 4.5% operate with less than $10k, reflecting how difficult it is to compete at modern speed and scale without meaningful financial support.

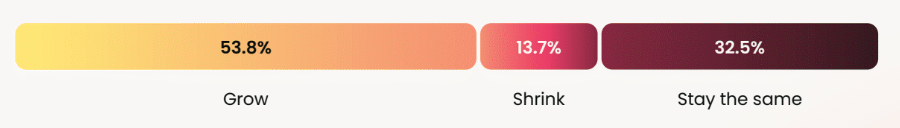

Budget growth is expected to continue: 53.8% of marketers anticipate increases over the next three to five years, a clear signal that marketing is still viewed as a revenue engine rather than a cost center. But at the same time, marketers report stronger demands for proof of performance.

As Petr Hlousek, CMO at ALVAO, put it, “The most dangerous thing about a bigger marketing budget is pretending it replaces thinking.” The message is clear: investment alone isn’t enough. Strategy, clarity, and measurable impact matter more than ever.

Marketing budgets are getting bigger and more strategically distributed

Marketing budgets continue to span a wide range, but this year’s distribution makes one trend undeniable: larger budgets are fast becoming the default in competitive markets.

The rise of paid media, content production, AI tools, and martech complexity has pushed many organizations to treat marketing as a critical growth driver.

The most common budget tier ($1M+) underscores this shift. Companies in tech, B2B SaaS, and global consumer sectors increasingly see seven-figure budgets as table stakes for maintaining visibility and pipeline momentum.

Still, budget size doesn't determine success.

Teams that lack strategic clarity often spread spend too thinly or reactively chase trends – an issue echoed by RightMetric’s Co-CEO Charlie Grinnell, who warns that “if you don’t have a sharp strategy anchoring the spend, more budget just creates more noise.”

Who’s working with $1M+ budgets?

High marketing budgets are most common in organizations with complexity, global reach, and mature growth strategies. Among marketers with $1M+ budgets:

- 28.6% work at companies with 1,001–5,000 employees, where marketing teams are typically structured across multiple functions and markets.

- 23.8% work at mid-sized, fast-scaling organizations with 201–500 employees – proof that aggressive growth-stage companies are investing heavily to capture market share.

- Just 4.8% come from small businesses with 11–50 employees, where resources are more limited, and priorities often lean toward operational needs.

This distribution aligns with broader industry patterns: as organizations evolve from early-stage to growth-stage to enterprise, the sophistication and cost of marketing rise dramatically.

Budgets by region: Western markets still lead the pack

Geography plays a major role in how much organizations invest in marketing.

North America continues to lead, with 47.6% of companies reporting annual marketing budgets over $250k and 13.4% surpassing $1M. The United States, in particular, remains a high-investment environment where competition and customer expectations demand robust marketing activity.

Europe follows closely behind, though with more variance between regions. 20.7% of European organizations exceed the $250k threshold, and 11% spend more than $1M. Economies like the UK and the Netherlands – both marketing-intensive hubs – help elevate these averages.

Investment drops significantly in other parts of the world:

- India (Asia): 3.7%

- South Africa (Africa): 2.4%

- Australia (Oceania): 1.2%

These gaps reflect differences in purchasing power, market size, martech adoption, and organizational structure. Sample sizes prevent broad generalization, but the trend is clear: budget-heavy marketing remains concentrated in Western markets where competition and customer acquisition costs are highest.

Where the money is going

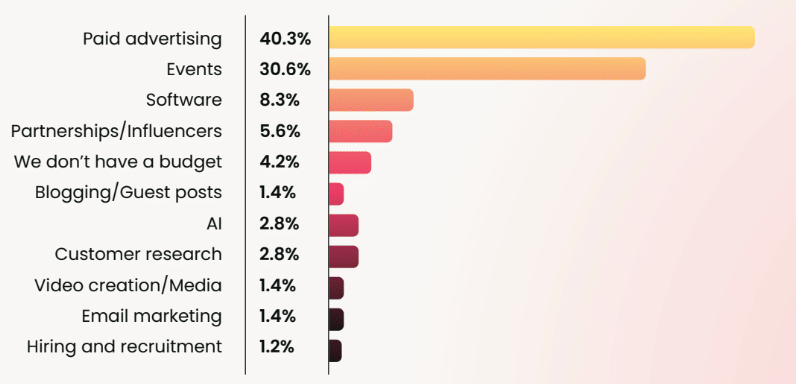

When marketers were asked where the majority of their budget is spent, two categories rose far above the rest: paid advertising (40.3%) and events (30.6%).

Paid advertising: Still the fastest path to pipeline

Paid advertising continues to command the largest share of investment. With targeting capabilities, instant reach, and strong attribution frameworks, paid search and paid social remain essential growth levers – especially in competitive verticals.

Authena AG's CMO Rossana Rodgers notes that “budgets now go where attribution is clearest,” and paid channels – particularly those driven by user intent – still outperform most alternatives.

Events: The return of high-touch, high-value engagement

Events have re-emerged as a core investment area, especially in B2B sectors where relationships and credibility fuel long-term growth. In-person conferences, trade shows, and field events are seeing strong returns as companies look for deeper engagement beyond digital-only interactions.

Jessica Ruffin, Director of Product Marketing, points out that “Budgets are tighter, which means focus matters more than ever. We’re being more strategic, doubling down on what works, and saying no to distractions, even the flashy ones.”

Other categories: Underfunded but not absent

While software (8.3%), partnerships (5.6%), AI tools (2.8%), customer research (2.8%), blogging (1.4%), email (1.4%), and video (1.4%) appear low in the data, this reflects the survey's question: where the majority of the budget goes.

Projects still occur across these categories – but they aren't the primary line items.

A small but telling 4.2% of respondents report having no marketing budget at all, underscoring the resource gaps many small teams face.

Will budgets grow, shrink, or stay the same?

More than half of marketers – 53.8% – expect their budgets to grow over the next 3–5 years. This is an encouraging sign that leadership teams continue to view marketing as essential to expansion, differentiation, and customer acquisition.

However, 32.5% expect budgets to remain flat, often due to organizational maturity or slower market environments. Meanwhile, 13.7% expect cuts, typically tied to industries under cost pressure or teams still working to prove ROI.

Marketing leaders describe this environment as one of redistribution rather than reduction. Modefinance’s CMO, Alberto Gerin, observed in the report that budgets are being recalibrated toward UX, automation, and revenue-linked initiatives – areas that directly support LTV and reduce CAC.

Similarly, Zander Labs’ Heather Hurd notes, “Depending on your industry, marketing leaders can expect changes in the way budgets are allocated, and we're going to have to push much harder to make sure we're telling the right story about how we bring value to the organization, or we risk seeing those precious funds sent in other directions.”

The underlying sentiment is consistent: budgets are no longer guaranteed. They must be earned through clarity, measurement, and alignment with business outcomes.

Royal Canin’s Jelle Boeser frames the real challenge clearly: “Long-term strategic work gets cut first. Marketers have to defend the brand while proving they understand tomorrow’s numbers.”

And as Katherine Lehman puts it, “Every dollar has to prove its worth and fast.”

Conclusion

Marketing budgets are growing – sometimes significantly – but the expectations attached to them are growing even faster.

The combination of rising costs, advanced technology, and organizational scrutiny means that today’s marketers must be more disciplined, more data-driven, and more aligned with revenue than at any point in the last decade.

The organizations that will thrive in 2025 and beyond are those that invest where it matters most:

- Clear ICP alignment

- Revenue-linked programs

- Customer insights

- Automation and operational efficiency

- High-impact channels like paid media and events

As budgets become more strategic and more measurable, marketers who embrace accountability – and pair it with bold, focused strategy – will be the ones who continue to earn and expand their share of investment.

.png)

Follow us on LinkedIn

Follow us on LinkedIn